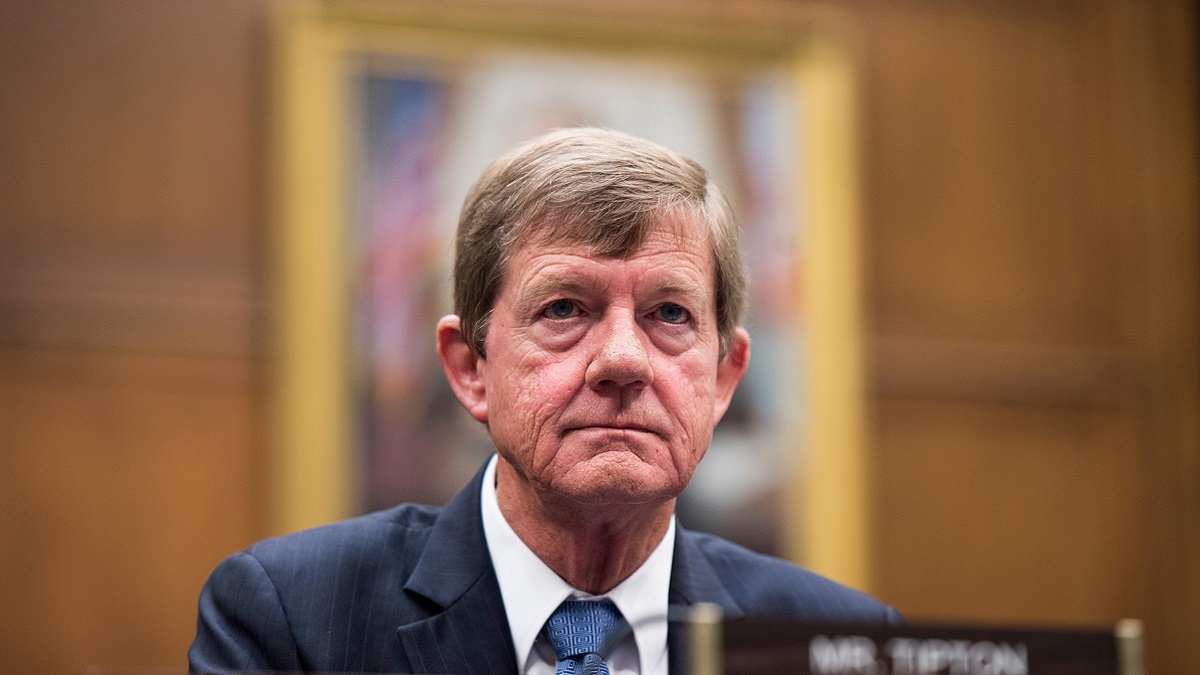

Rep. Scott R. Tipton | Roll Call

Rep. Scott R. Tipton | Roll Call

A Steamboat Springs hotel general manager recently appealed to his congressional representative to stop lenders from using "vulture tactics" to prey on borrowers hard struck by the COVID-19 pandemic's economic impact.

Lenders circling over the pandemic-distressed properties "are well within their legal rights," Residence Inn Steamboat Springs General Manager Grant D’Entremont said in his April 2 letter to Rep. Scott R. Tipton (R-CO).

In a copy of the two-page letter obtained by the Centennial State News, D’Entremont told Tipton that the lenders' scheme is "unconscionable from a moral perspective and stand starkly against the principles that we share here in the United States."

"Frankly, to take advantage of this crisis for the sake of better returns for some New York hedge fund strikes me as unAmerican," D’Entremont continued in his letter. "The negative impact to hotel owners and their employees of these vulture tactics will be long lasting."

D’Entremont urged Tipton to join with other members of congress, the Federal Reserve and other regulatory agencies "to address this situation before hotels across this country are mercilessly foreclosed on due to no fault of their own."

Residence Inn Steamboat Springs is a 110-room hotel on Pine Grove Road.

Tipton spent part of this week blasting Senate democrats "for politicizing small business relief," a press release on his House website said.

Tipton took particular umbrage with congressional democrats for stalling additional funds for the Paycheck Protection Program, which provides $350 billion in government-backed loans for small businesses. The program was part of the recently enacted Coronavirus Aid, Relief and Economic Security (CARES) Act.

"Many small businesses are uncertain whether there will be enough funds available by the time their emergency loan application gets considered," Tipson said in his press release. "Given the scale of the economic shutdown, Congress must be responsive to these concerns and take action to ensure that these critical employers and their employees are not shut out just because Congressional Democrats are engaging in petty political theater. Chuck Schumer and Nancy Pelosi need to put their divisive politics aside and prioritize helping American families and small businesses now, many of whom are unsure of when their next paycheck is going to come."

The $2 trillion CARES Act passed by Congress late last month provides some foreclosure relief, mostly for family-owned properties.

In addition, some states have set up foreclosure moratoriums and stays, often covering small and large properties from lender asset seizure when payments aren't made during the pandemic.

Colorado is one of those states thank's to Gov. Jared Polis' executive order issued March 20 adding 30 days to cure and redeem deadlines under the state's foreclosure status. The order is effective until April 20.

Larger properties received some protection in an interagency statement issued March 22 by the Federal Reserve, FDIC and other regulatory agencies that encouraged the nation's banks to work proactively with borrowers hit hard by the COVID-19 pandemic.

"The agencies encourage financial institutions to work prudently with borrowers who are or may be unable to meet their contractual payment obligations because of the effects of COVID-19," the statement said. "The agencies view loan modification programs as positive actions that can mitigate adverse effects on borrowers due to COVID-19. The agencies will not criticize institutions for working with borrowers and will not direct supervised institutions to automatically categorize all COVID-19 related loan modifications as troubled debt restructurings (TDRs)."

D’Entremont called the interagency statement "undoubtedly a step in the right direction" but said not all borrowers have loans from FDIC-insured banks.

"However, billions of dollars of hotel loans in our country come from unregulated non-banks such as hedge funds and other investment funds," D’Entremont's letter said. "Since the Federal Reserve and the FDIC have no direct oversight of these firms, they are unlikely to follow the previously mentioned guidance. They are more likely to take a different approach: the use of vulture tactics to extract as much 'value' out of the hotel as possible without any regard for the current crisis or the hotel employees or hotel owners involved."

Those "vulture tactics" include accelerating the foreclosure process to gather in as many COVID-19-distressed properties as possible, using "small technical ways" to rush loan defaults, denying borrowers existing escrowed funds and slowing reimbursements on collateral, D’Entremont's letter said.

"Representative Tipton, I urge you, Congress, the Federal Reserve and other governmental agencies to move quickly to address this situation before hotels across this country are mercilessly foreclosed on due to no fault of their own," D’Entremont's letter said. "To the extent additional legislation related to COVID-19 is proposed, I would recommend adding language that introduces an 18-month moratorium on ALL foreclosure proceedings for ALL lenders to hotels. This should give hotels the time they will need to come up with reasonable solutions and strategies with their lenders to ensure that they have their loans paid off and avoid unnecessarily enriching hedge fund vultures."

Alerts Sign-up

Alerts Sign-up